Tenant satisfaction is an important factor in the commercial real estate profitability equation. Properties with high tenant satisfaction have lower vacancy rates, retain tenants longer, command premium lease rates, and are ultimately more profitable. They’re also more marketable and with higher property values.

There are many elements of tenant satisfaction including property location, building aesthetics and comfort, maintenance and operating costs, and landlord or property manager responsiveness.

According to an extensive study conducted by the University of Guelph, Ontario, Canada:

Environmental friendly, or “green” buildings, are those that meet energy efficiency and sustainability standards based on three different certification programs: LEED, BOMA BEST, and ENERGY STAR.

The study found:

- Average rents were 3.7% higher

- Occupancy rates 9.5% higher

- Tenant satisfaction scores 7.0% higher

- Energy consumption per square foot 14.0% lower

Characteristics of “green” buildings include renewable energy capabilities, high efficiency HVAC and lighting systems, energy efficient windows and doors, reflective roofs, and high R-Value insulation throughout the building. These upgrades require capital-intensive investments negatively affecting cash flow, at least in the short run.

If self-financed, this drains available cash potentially used for acquisitions or other property improvements. And it can reduce funds for normal operating expenses such as maintenance and housekeeping, possibly diminishing tenant satisfaction resulting from the “green” upgrades. If financed with traditional loans, they’re frequently due long before sufficient energy has been saved to pay them off.

A problem with most green renovations of commercial real estate is that the associated capital expense ultimately saves the tenant money but not necessarily the building’s owner. This is especially true with triple-net leases.

An Alternative Option for Funding “Green” Upgrades

Eliminating the disadvantages of self-funding, or financing “green” upgrades with conventional loans, is one of the primary reasons Curt Monhart of E3 Prime Environments uses Property Assessed Clean Energy (PACE) financing on company projects. The unique characteristics of PACE financing supports energy efficiency upgrades through the use of a funding mechanism that often results in a positive cash flow while increasing tenant satisfaction and building profitability.

Similar to streets, sidewalks, sewers and similar improvements, PACE loans are repaid with a special assessment on the owner’s property tax.

“The opportunity that PACE offers is the ability to do the project while allowing for cash on hand to go toward growing the business rather than funding the building updates.”

For owners of commercial real estate, there are several advantages of PACE loans compared to traditional funding options, the most common of which are commercial bank loans and long-term equipment leases.

- Protects cash on hand – 100% project financing no down payment required

- Low annual payments – up to 25 year financing at fixed interest rates

- Limits owner liability – non-recourse (financing secured by property)

- Loan amount determined by property value – not owner’s net worth

- Can be considered “off-balance-sheet” – protects the owner’s borrowing capacity for other projects

- Property assessment transfers seamlessly if the property is sold – loan does not have to be paid off

- Supports more property upgrades due to 100% financing

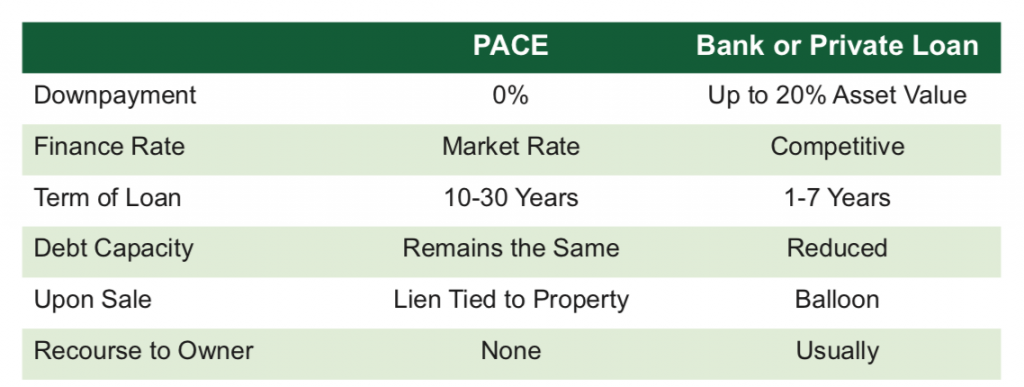

Here’s a breakdown of the difference between project financing using PACE vs. a traditional bank loan:

If you’re a building owner and are considering CAPEX projects it’s important to learn about the unique financial benefits of PACE outlined in a free report entitled Energy Efficiency CAPEX Driving Financial Performance. The report is available immediately HERE and explains the many benefits of PACE financing and the kind of upgrades which qualify for PACE.

Regardless of the funding option, advantages of energy efficiency upgrades include:

- Increases Net Operating Income (NOI) through a reduction of energy expenses, reduced maintenance and end-of-life equipment costs – results in higher property values

- Improves tenant satisfaction – minimizes tenant energy costs while improving environmental comfort

- Higher occupancy and lease rates

- Increased asset value – modernization of older, inefficient technologies

- Improves building marketability

Building owners hire E3 Prime Environments to solve funding concerns while creating ideal building environments in terms of energy and water consumption, comfort, productivity and sustainability. Our scope of work includes commercial, industrial, multi-family and non-profit buildings, as well as agricultural applications. Project development work includes identifying and quantifying opportunities for saving energy and water-including the adoption of renewable technologies-recommending the optimal funding option, ensuring all project-eligible utility rebates and incentives are taken advantage of and providing project management support.

Leave a Reply