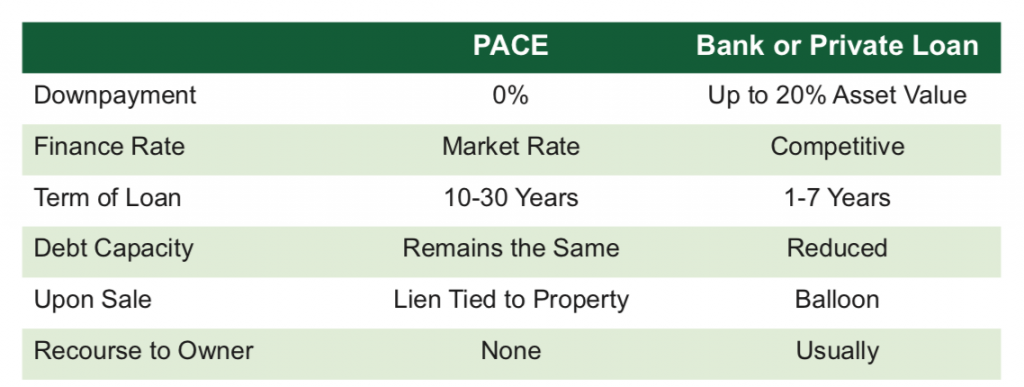

When evaluating funding options for energy efficiency upgrades, all too often building owners only focus on the interest rate, believing the one with the lowest is ideal. This typically limits the options to short-term commercial loans.

With the advent of Property Assessed Clean Energy (PACE) financing, the newest and most innovative funding option for energy efficiency upgrades, the interest rate has become one of the least important factors when choosing an appropriate funding mechanism.

PACE is currently available in 34 states plus Washington DC. In these areas it is rapidly becoming the preferred option for financing energy saving upgrades to commercial, industrial, multi-family and non-profit facilities. PACE loans are repaid by a voluntary special assessment on the building owner’s property tax, similar to those levied for streets, sidewalks, sewers and other community improvements.

Each PACE district may have different qualifications for securing a PACE loan, so it’s important to discuss your particular situation with a local PACE administrator or project developer. As with all loans, the borrower’s long-term credit worthiness is always a factor. But from a project perspective, if the energy savings of a particular energy efficiency upgrade can be accurately calculated, it most likely will qualify for PACE funding.

Here’s a short list of the benefits which make PACE financing an important addition to the capital stack:

- Terms of 15-25 years at a fixed interest rates – Most commercial loans are typically for a term of 3-5 years. In the majority of cases, there hasn’t been sufficient energy savings from the upgrades to cover the total loan amount. When it’s due, owners either dip into their cash flow to pay it off, or, if even an option, renegotiate it at whatever the going interest rate is at the time. On the other hand, 15 – 25 years are common terms for a PACE loan at fixed interest rates. Even long payback upgrades such as solar and geothermal will have paid back long before the total property tax special assessments have all been levied.

- 100% financing – Most traditional loans require the borrower to put down 20-30%. PACE provides 100% financing for the total upgrade including audits, equipment, labor, materials, engineering, legal and financial – every cost associated with the project.

- Non-recourse – For traditional loans the owner is always personally responsible. For PACE loans the property secures the loan. If for whatever reason the owner can no longer pay his property taxes, including the special PACE assessment, he is not held personally liable for the remaining balance since the property has secured the loan.

- Can be considered “off-balance-sheet – Traditional loans are a liability negatively impacting the owner’s credit worthiness for future borrowing. Since PACE is repaid with a special property tax assessment, it’s considered an expense, not a long-term liability. This preserves the owner’s borrowing capacity for other projects.

- Freedom to sell the building – Assessments remain with the property and transfer seamlessly to the new owner.

For upgrades of $250,000 and more, the Michigan PACE program requires that the resultant savings be greater than the entire cost of the project including equipment, labor, material, audits, legal and financing – every cost associated with the project. In other words, it must be cash flow positive following the project. This means if a building owner undertakes an energy efficiency project that’s $250K or more, they will actually be more profitable than maintaining the status quo with present energy-consuming technologies.

“…a PACE loan is better than conventional debt used for similar upgrades because it is typically cheaper, it has a fixed interest rate and terms are 20 to 30 years instead of three to five.” The New York Times

Another benefit of the PACE program is that a building owner can actually self-finance the loan. Now the common response to hearing this is “how is that a benefit since the owner is responsible for paying the interest?” The answer is if the owner sells the building before the loan is fully repaid, quite common with commercial and multi-family building, the interest on the loan becomes an annuity for the remaining term of the loan. In many cases the PACE interest rate is higher than the owner is able to earn on traditional investments.

If you would like to learn more about PACE you can download the free report: PACE For Driving Commercial Real Estate Financial Performance or consider attending the upcoming West Michigan PACE Summit on October 10th hosted by Lean and Green Michigan.

“Funding is the number one obstacle to energy efficiency projects going forward. PACE very effectively removes this obstacle and is rapidly becoming the preferred funding choice as the demand for energy efficient properties grows.” Curt Monhart

Leave a Reply